The Peter Orszag house story reveals fascinating insights into how Wall Street’s elite choose their homes and it’s not what you’d expect from typical CEO excess.

Peter Orszag, now CEO and Chairman of Lazard since 2025, previously owned a stunning Victorian residence in Washington DC’s ultra-exclusive Kalorama neighborhood. The 5,000+ square foot property with six bedrooms sold for $3.45 million in 2020, marking the end of an era tied to his government service and transition into high finance. Today, he’s based primarily in New York’s metropolitan area, where Lazard’s Manhattan headquarters anchor his global leadership role.

His Peter Orszag net worth estimated between $10–16 million from Lazard stock and years of executive compensation supports a sophisticated yet refreshingly understated lifestyle. Unlike flashy tech CEOs or celebrity executives, Orszag’s real estate choices prioritize strategic location, timeless quality, and family functionality over architectural showpieces.

This comprehensive examination pulls from public real estate records, financial filings, and media reports (updated January 2026). We’ll tour the Kalorama Victorian’s elegant features, examine why location drove every decision, and explore how his shift to New York living reflects the evolution from policy wonk to financial powerhouse. We’ll also touch on his remarkable Peter Orszag education credentials and family life with five Peter Orszag children that shaped these housing needs.

Last Updated: January 16, 2026

Quick Stats: Peter Orszag House at a Glance

| Feature | Details |

|---|---|

| Owner | Peter Orszag (former, sold 2020) |

| Location | Kalorama neighborhood, Washington DC |

| Property Type | Victorian-style single-family residence |

| Sale Price | $3.45 million (2020) |

| Property Size | 5,000+ square feet |

| Bedrooms | 6 |

| Bathrooms | Not publicly disclosed (estimated 5-6) |

| Year Built | Late 19th/Early 20th century (Victorian era) |

| Architectural Style | Classic Victorian with original period details |

| Lot Features | Mature landscaping, established trees, front garden |

| Special Features | Original fireplaces, bay windows, high ceilings, hardwood floors, ornate moldings |

| Ownership Period | Approximately 2009-2020 |

| Current Status | Sold to private owners (2020) |

| Current Residence | New York metropolitan area (specific address private) |

| Neighborhood Highlights | Diplomatic embassies, former officials, walkable to Dupont Circle |

| Estimated Original Purchase | $2-2.5 million (not publicly confirmed) |

| Appreciation | Estimated 40-70% during ownership |

Peter Orszag Personal Stats

| Category | Information |

|---|---|

| Full Name | Peter Richard Orszag |

| Born | December 16, 1968 |

| Education | Princeton University (BA Economics, summa cum laude); London School of Economics (PhD, Marshall Scholar) |

| Current Position | CEO & Chairman of Lazard (since 2025) |

| Previous Roles | OMB Director (2009-2010), CBO Director (2007-2008), Citigroup Vice Chairman (2011-2016) |

| Net Worth | $10-16 million (estimated, late 2025) |

| Primary Assets | ($9-10M), real estate, investments |

| Marital Status | Married to Bianna Golodryga (CNN journalist, since 2010) |

| Children | 5 (from multiple relationships) |

| Previous Marriage | Cameron Hamill (divorced 2006, 2 children) |

Disclaimer: This article synthesizes publicly available data as of January 2026, including real estate records, SEC filings, media reports, and biographical sources. Financial estimates represent publicly reported figures or analyst estimates, not confidential information.

Who Is Peter Orszag? The Mind Behind the Mansions

Academic Excellence and Government Impact

Peter Richard Orszag, born December 16, 1968, built his career on intellectual firepower. His Peter Orszag education started at Princeton University with a summa cum laude Economics degree, followed by a PhD from the London School of Economics as a Marshall Scholar credentials that launched him into the highest policy circles.

His government tenure included directing the Congressional Budget Office (2007-2008) and serving as President Obama’s first Director of the Office of Management and Budget (2009-2010). During the darkest days of the 2008-2009 financial crisis, Orszag helped shape America’s fiscal response while commuting from Kalorama to the White House.

Wall Street Ascent and Current Role

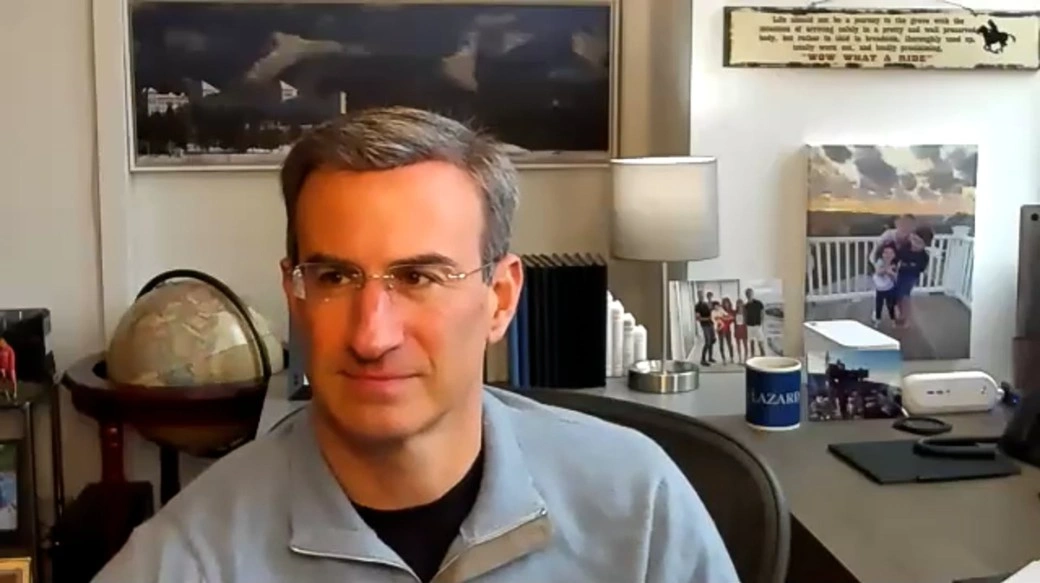

After leaving government, Orszag joined Citigroup (2011-2016) before moving to Lazard in 2016. He climbed from managing director to CEO of Financial Advisory, then overall CEO in 2023, adding Chairman duties January 1, 2025. His Peter Orszag net worth of $10-16 million stems largely from approximately 183,000 Lazard shares (worth roughly $9-10 million in late 2025) plus executive compensation.

Family Life Shapes Housing Needs

Orszag has five Peter Orszag children: two from his first marriage to Cameron Hamill (divorced 2006), one from a relationship with Claire Milonas, and two with wife Bianna Golodryga (CNN journalist, married 2010). This blended family of seven demanded the spacious, secure Kalorama setup six bedrooms weren’t a luxury, they were necessity.

His homes reflect disciplined thinking: heritage over trends, location over excess, privacy over publicity.

The Kalorama Victorian: Architecture Meets Strategy

Ownership Timeline and 2020 Sale

Orszag likely acquired the Kalorama property around his OMB appointment, needing a Washington base during crisis management years. The home served through his government-to-finance transition, providing stability while careers pivoted.

The 2020 sale at $3.45 million signaled full commitment to New York and Lazard. No original purchase price exists publicly, but the sale amount suggests solid appreciation in one of DC’s most stable luxury markets. No major renovations were reported he preserved the Victorian integrity rather than modernizing character away.

Why Kalorama? Location Decoded

Kalorama ranks among DC’s most prestigious addresses. The Greek-derived name means “beautiful view,” and the neighborhood delivers: tree-lined streets, diplomatic embassies, architectural preservation, and zero tourist traffic.

Strategic advantages for a budget director:

Commute efficiency: Minutes to the White House and Treasury critical during 16-hour crisis days

Elite discretion: Former officials and ambassadors as neighbors who value the same privacy

Family infrastructure: Top schools, safe streets, cultural resources for raising children

Market stability: Limited inventory and diplomat demand sustain premium pricing

Properties exceeding 5,000 square feet routinely command $3+ million. The Obamas, Ivanka Trump, and various cabinet members have called Kalorama home creating a self-reinforcing prestige cycle.

Victorian Elegance: Exterior and Architectural Style

The Peter Orszag house exemplified classic late-19th century DC Victorian architecture ornate but never garish, substantial without excess.

Characteristic features:

Detailed facades: Brick or stone construction with contrasting materials creating visual depth

Bay windows: Period-appropriate projections flooding interiors with natural light

High ceilings: Grand vertical spaces showcasing elaborate moldings and craftsmanship

Mature landscaping: Established trees and professional plantings providing privacy screening

Classic entryways: Covered porches with period railings and architectural detail

Imagine stately brick, perhaps three stories, with tall shuttered windows framed by mature oaks. A small front garden transitions from sidewalk to private entrance dignified, established, quietly expensive. Exactly what you’d expect from a former budget director with zero tolerance for flashy excess.

Interior Layout: 5,000+ Square Feet of Functional Luxury

Room Configuration for Executive Family Life

Six bedrooms across 5,000+ square feet offered generous space without waste. Typical Victorian layouts organize hierarchically:

Main floor: Grand living room with original fireplaces, formal dining for policy dinners, updated kitchen opening to family areas, home office or library for late-night work sessions

Upper floors: Primary suite with en-suite bath, five additional bedrooms with updated bathrooms and generous closets for growing children

Lower level: Likely finished for recreation, storage, possibly home gym practical family space

Design Elements Worth Noting

Original details preserved: Hardwood floors, intricate moldings, working fireplaces, built-in bookcases Victorian craftsmanship that modern construction cannot replicate

Strategic modernization: Updated kitchens and baths with stone counters, professional appliances, contemporary fixtures all installed respecting period aesthetics

Technology integration: For a tech-savvy economist, discreet smart systems seem likely automated climate, security, entertainment invisible to maintain historic character

Natural light maximized: Large windows, high ceilings, strategic orientations creating bright, welcoming spaces

What’s Missing (By Choice)

No reports mention home theaters, wine cellars, resort pools, or architectural statements. The focus stayed practical: comfortable spaces for family life, professional entertaining, and policy work spilling from office to home.

This restraint reflects Orszag’s profile disciplined economist, not flashy CEO. Function over gimmicks, quality over show.

The New York Transition: Following the Money

Geographic Shift Mirrors Career Arc

While Kalorama defined his Washington years, Orszag’s primary residence shifted to New York’s metropolitan area post-2020 a move perfectly aligned with Lazard leadership demands.

New York advantages:

Headquarters proximity: Lazard’s Manhattan offices require CEO presence; living nearby eliminates friction

Financial ecosystem: Wall Street’s concentration of clients, competitors, talent makes New York essential for global finance leadership

International connectivity: JFK and Newark provide critical links to worldwide operations

Cultural capital: World-class dining, arts, education matching sophisticated executive lifestyle

Current Lifestyle Context

Specific addresses remain appropriately private executives at this level maintain security through discretion. However, likely parameters include:

High-end Manhattan co-op or condo (Upper East Side, Tribeca, similar established areas), doorman building with private elevator access, space-efficient design maximizing quality over square footage, professional convenience trumping residential display.

The shift from 5,000+ square feet to likely smaller New York footprint reflects changing needs: children aging out, work intensifying, urban convenience replacing suburban space.

Strategic Real Estate Philosophy: Lessons from Orszag’s Choices

Quality Over Excess

The Peter Orszag house trajectory illustrates sophisticated executive thinking about residential real estate:

Heritage beats trends: Victorian preservation suggests traditional values, long-term thinking these homes appreciate steadily while modern experiments age poorly

Location follows career: DC for government proximity, New York for financial ecosystem access physical base aligns with professional gravity

Privacy protects options: Low-key profile prevents personal real estate from becoming professional liability no tabloid purchases, no architectural ego trips

Strategic timing matters: Selling when property no longer serves primary function captures appreciation, redeploys capital efficiently

Appropriate scale suffices: Six bedrooms served a family of seven; no need for 10,000+ square foot ego monuments

Comparative Context: Executive Housing Trade-offs

Orszag’s choices reveal broader patterns successful professionals navigate:

Display vs. Discretion: He chose quiet quality minimal publicity signals substance over show, unlike celebrity CEOs courting architectural media coverage

Investment vs. Consumption: Real estate balanced wealth building (solid Kalorama appreciation) with lifestyle function (family space, work proximity)

Flexibility enables transitions: No emotional attachment to property sold when strategy shifted, demonstrating disciplined capital allocation

For professionals considering residential strategy, Orszag’s pattern offers insights: geographic arbitrage (buying appreciating markets), quality selection (historic homes preserve value), strategic leverage (real estate allows modest borrowing without excessive risk).

Financial Analysis: The $3.45M Sale in Context

Market Dynamics

The 2020 sale price reflected several factors:

Kalorama premium: Limited inventory and diplomatic demand sustain top-tier DC pricing

Square footage value: 5,000+ square feet with six bedrooms aligned with luxury standards

Historic preservation: Original Victorian details add irreplaceable value

COVID timing paradox: Despite pandemic uncertainty, high-end single-family homes with space saw strong 2020 demand

Net Worth Integration

With Peter Orszag net worth at $10-16 million, the Kalorama property represented significant but not dominant allocation. Assuming a purchase around $2-2.5 million (market speculation), 40-70% appreciation during ownership validated location and quality choices.

Selling and shifting to New York real estate maintained diversification balancing Lazard stock concentration with tangible residential assets. This mirrors his professional expertise: analytical, strategic, disciplined wealth management.

Visit Also: Nana Patekar Farm House

Conclusion: Real Estate Reflecting Refined Success

The Peter Orszag house story demonstrates how disciplined executives approach residential real estate not as status symbol, but as strategic asset aligned with career and family evolution.

The Kalorama Victorian represented a life chapter: raising children during government service and early finance years, requiring Washington proximity, family space, and elite discretion. Its classic architecture and substantial scale served perfectly without excess.

The 2020 sale and New York transition marked professional evolution: from DC policy to Wall Street leadership, from family home to executive efficiency, from suburban space to urban convenience. Throughout, choices emphasized quality, strategy, and privacy principles driving both professional success and personal lifestyle.

? Frequently Asked Questions

Where is Peter Orszag’s house located?

His most notable residence was in Washington DC’s Kalorama neighborhood an exclusive historic area known for embassies and high-profile residents. The Victorian property sold in 2020 for $3.45 million. He currently resides primarily in the New York metropolitan area near Lazard’s Manhattan headquarters, though specific addresses remain private for security.

How much is Peter Orszag’s home worth?

The Kalorama Victorian sold for $3.45 million in 2020. His current New York residence value hasn’t been disclosed, though comparable executive Manhattan properties typically range $3-10+ million. His overall Peter Orszag net worth is estimated $10-16 million as of late 2025.

Can you visit Peter Orszag’s house?

No. The former Kalorama property is now privately owned with no public access. His current New York residence is likewise private typical for financial executives and former officials who prioritize security and discretion over publicity.

Who designed Peter Orszag’s home interiors?

Specific designers haven’t been publicly credited. The Kalorama Victorian’s value lay in preserved period architecture rather than celebrity designer involvement. Any updates focused on respectful modernization upgraded kitchens and baths maintaining architectural integrity.